SNE research found that many famous EV brands growing very rapid due to the lithium battery developed fast recent years.

“The growth rate of China’s BYD, Funeng Technology, CATL and other companies in other markets around the world other than the Chinese market is ‘frightening.'” At the beginning of this year, South Korea’s SNE Research once commented on the development of installed capacity of China’s leading power battery companies. status quo.

SNE Research also said that since Tesla has driven price competition for electric vehicles, Chinese battery companies are expected to target other markets around the world besides the Chinese market, especially in the use of lithium iron phosphate batteries, based on the price differentiation strategies of vehicle manufacturers. Europe, which has a relatively low sales rate, has opened up a new blue ocean with lithium iron phosphate batteries as its main product.

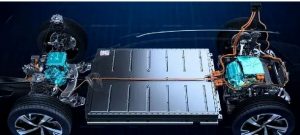

In fact, Europe, as the birthplace of the automotive industry, occupies an important position in the global automotive industry chain. Affected by this, the world's leading power battery companies are actively accelerating their deployment in Europe, including new generation products such as ternary, lithium iron phosphate, lithium iron manganese phosphate, and sodium-ion batteries, covering square, large cylindrical and other types, as well as ultra-fast charging and other new technologies are rapidly penetrating into Europe.

Recently, at the 2023 German International Automobile and Smart Mobility Expo, about 70 Chinese companies participated in the exhibition. Among them, in the field of power batteries, all leading Chinese power battery companies such as CATL, Everview Lithium Energy, Sunwoda, and Ruipu Lanjun The presence at the event demonstrated the extraordinary strength of the "Chinese Battery Group", and each company also revealed its European market layout.